ICSID-SIMC MOU Signing Ceremony and Panel Discussion: Challenges and Opportunities in Investor-State Mediation

The International Centre for Settlement of Investment Disputes (ICSID) and SIMC commemorated a key partnership with a signing ceremony and panel discussion on 26 March. The MOU provides for the use of SIMC’s facilities and services for mediation proceedings under the auspices of ICSID, as well as enhanced technical collaboration between the two centres. Over 60 participants tuned in from across 15 countries to join the celebratory event online.

We reproduce some of the key points from the event below. The full recording can be viewed here:

Giving his opening remarks, ICSID Deputy Secretary-General Mr Gonzalo Flores emphasised the significance of the MOU for ICSID. Mr Flores said: “This [MOU] reflects the fact that mediation is today a key focus of our work.”

Mr Flores commended SIMC and ICSID’s efforts to raise awareness of mediation as an investor-State dispute resolution tool, and build capacity amongst practitioners on the skills required to mediate investor-state disputes. He also made reference to ICSID’s current work in developing new procedural rules for mediation, designed specifically for investor-State disputes.

Speaking on behalf of SIMC, SIMC Chairman Mr George Lim SC expressed his honour and delight to be entering into the MOU with ICSID. Mr Lim also shared his newfound perspective of investor-state disputes. During a recent session of the UNCITRAL Working Group III on Investor-State Dispute Settlement (ISDS) reform, a delegate whose country faced a multi-billion dollar claim from an investor said that his country would face devastating economic effects should it lose the case.

Reflecting on this, Mr Lim noted that “if not managed timely and well, the outcomes may adversely affect international trade, or even cripple economies, particularly those of smaller and poorer nations.” Mr Lim added that early intervention gives parties a chance to preserve relationships – this is where mediation plays a role.

Noting the ‘encouraging’ statistic that some 35 per cent of ICSID cases are either settled or discontinued, Mr Lim said: “Hopefully with this collaboration, we will be able to promote the use of mediation and encourage States and investors to resolve their differences amicably.”

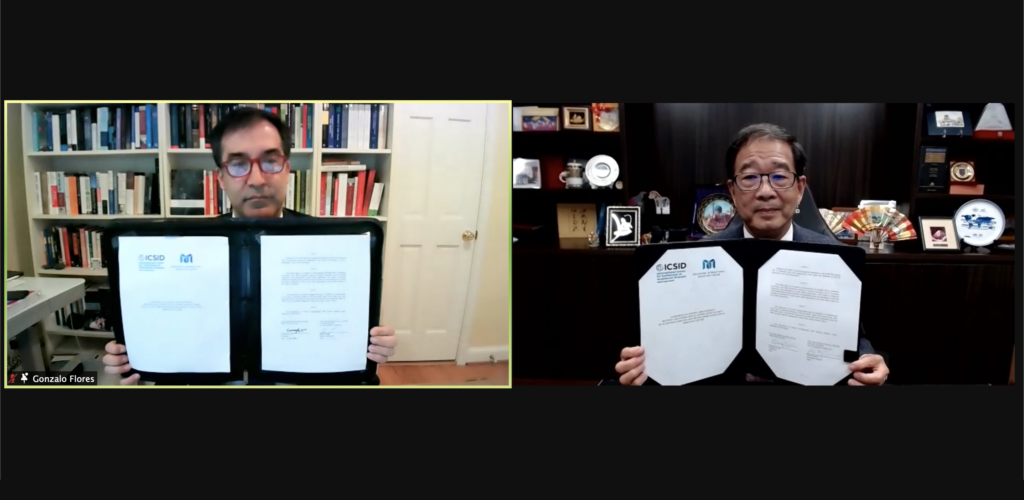

The opening remarks were followed by the official signing ceremony, with Mr Flores signing on behalf of ICSID, and Mr Lim on behalf of SIMC. The signing was witnessed by over 60 participants online, including many senior lawyers and practitioners in the fields of mediation and ISDS.

Mr Gonzalo Flores, ICSID Deputy Secretary-General (left) and SIMC Chairman Mr George Lim SC, signing the MOU.

Panel Discussion: Challenges and Opportunities in Investor-State Mediation

The second half of the event featured a panel discussion focussing on the opportunities and challenges of investor-State mediation.

Panel moderator Anna Holloway (Legal Counsel, ICSID), gave some background on investor-State mediation and the context of ICSID’s upcoming Mediation Rules. She explained how ICSID had recognised the growing momentum behind mediation as it began its rules amendment process in 2016.

With factors such as an increasing number of bilateral and multilateral investment treaties providing for mediation and the coming into force of the Singapore Convention on Mediation, ICSID found that States and other actors within the international community were pushing for mediation to “become a bigger part of the menu for ISDS.” These landscape shifts culminated in ICSID’s decision to develop the ISDS Mediation Rules, “the first set of institutional rules designed specifically for investor-State disputes,” Ms Holloway noted.

International arbitrator and mediator, Mr Wolf von Kumberg, elaborated on the utility of mediation for investor-State disputes. Having been an in-house counsel for a number of technology companies over the course of his career, Mr von Kumberg shared that “[he] saw first-hand the way that investment disputes could be destructive, not only for the companies...[but] for States themselves.” He continued: “We have to remember that investors come at an investment from a commercial perspective [...] but States have a very different perspective...we often forget that States are not only coming at this from the commercial perspective but they also have social and policy considerations against a political background.”

In addition to the commercial rationale for mediation as an effective and efficient method of dispute resolution, Mr von Kumberg highlighted the advantage of early use of mediation for States, and the growing openness to using mediation as a tool alongside the traditionally utilised method of arbitration: "It is amazing the response that we’ve received, to looking at mediation as an additional mechanism that can be employed in order to resolve these disputes...because obviously in many cases, there’s a relationship there that – if the dispute is caught at an early stage – might be maintained, to the benefit of both the investor and the State.”

All this being said, Mr von Kumberg identified a few existing obstacles that continue to hinder States’ negotiation of settlements through mediation. These include:

- Avoidance of political liability by state officials in settlement negotiation processes

- The lack of administrative frameworks and processes for dealing with disputes

- The need to uphold confidentiality in proceedings whilst remaining sufficiently transparent

- The lack of clarity regarding state budgets when it comes to fulfilling settlement agreements.

Mr von Kumberg made reference to the efforts of institutions such as ICSID, the Energy Charter Treaty and the International Mediation Institute (IMI) in recent years to overcome these obstacles, with new publications, frameworks, and standards to assist investors and States in understanding mediation, and practically incorporating it within their internal processes.

Guests also heard from Singapore international arbitrator and mediator, Prof Lawrence Boo. Prof Boo expressed his conviction that mediation had an important role in helping to resolve investor-State disputes: “I have seen far too often whole states that have been found liable for breaches...suffer[ing] more than they should in terms of cost [and] the negative image that comes with a drop in credit rating that would have come following the making of the award.”

Elaborating further, Prof Boo said: “When you look at cases that are reported that have been decided against States, some of these breaches are not egregious, some of them are negligence, some of them may be a wrong decision made by a politician, or wrong policies promulgated by a new government or the previous government. The sad thing is that the whole state has to bear the whole burden of the errors of a few individuals, which then causes a lot of hardship on people of developing States, sometimes impoverishing them.”

Prof Boo also offered some learnings from his practice in commercial arbitration, to encourage the use of mediation. For instance, providing a window for parties to engage and consider mediation within the procedural timetable. From experience, Prof Boo has found that parties welcome this opportunity, and believes that such a window “prompts parties in the right direction” by serving as a “signpost for parties to pause and ponder so that no one is seen as weak”.

Building on Mr von Kumberg’s comments regarding the use of mediation alongside arbitration, Prof Boo explained the arbitrator’s role and responsibility to promote this: “...as an arbitrator [...] we have a duty to assist people to resolve their disputes. In solving their disputes, it’s not necessarily adjudicating rights and wrongs. A dispute can be resolved through other means, even if the matter has now appeared in an arbitration.”

Prof Boo encouraged the arbitration community to facilitate proceedings such as Arb-Med-Arb, as a means of achieving settlement, recognising that “mediation can be commenced at any time and at any stage, even during the arbitration”. On the future of such hybrid processes, Prof Boo said: “I can see [Arb-Med-Arb] being used for investor disputes, because there is actually a window for investor state arbitration to provide for such a process. It all depends on the tribunal. The tribunal must be enlightened and be bold enough to want to do it.”

Prof Boo also pointed to the ‘refreshing’ developments in Investment Treaties with regards to mediation. He referred to the recent Bilateral Investment Treaty (BIT) between Singapore and Indonesia, which makes specific provision for mediation. Whilst not mandating mediation, this gives parties the voluntary option for mediation.

In the final Q&A segment, Mr von Kumberg and Prof Boo spoke to the growing mediation culture in the legal sector, across many jurisdictions, as lawyers and firms increasingly view mediation as one of the many effective dispute resolution mechanisms available for resolving investor-State disputes.

Looking forward, the MOU takes its place within a broader shift in the world of ISDS. As articulated by Prof Boo’s commendation: “[the MOU] is not just a signing; I think it marks a very good beginning. It is a very good start in progressing [and] pushing gently albeit, State parties in particular, to adopt mediation processes in resolving their disputes with investors. I hope this helps to encourage them.”